If you are your own boss, does that mean you are self-employed? In essence, yes, freelancing is recognised as a form of self-employment. However, it's crucial to understand that self-employment can encompass more than just freelance work.

While freelancing is self-employment, the category also includes running small enterprises or trades. Freelancers usually work as sole contractors, delivering specific services to various clients without the typical employer-employee ties. Meanwhile, self-employed individuals might include entrepreneurs running their own trades or businesses.

The Link Between Freelancing and Self-Employment

Freelancing nowadays is widely acknowledged as self-employment, offering people the chance to pave their paths in a career guided by their own hands. Freelancers and other self-employed individuals alike relish a degree of independence in managing their vocations.

Freelancers often carry out work on a project-by-project basis, offering skills like writing, design, or advisory services.

Whether a freelancer or another self-employed person, responsibilities such as managing their finances, dealing with taxes, and making critical business decisions are shared.

While flexibility is a significant feature, staying disciplined and organised is vital.

Example

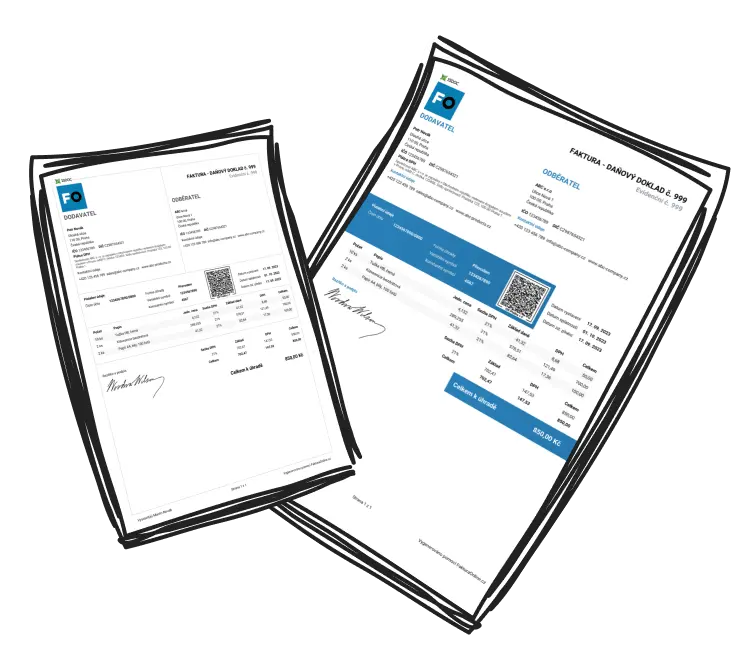

A freelance graphic designer might independently seek clients, undertake marketing efforts, determine pricing, and create invoices, illustrating self-employment traits.

Understanding Freelancer Self-Employment in the UK

Being self-employed as a freelancer goes beyond just freedom, encompassing significant responsibilities. Freelancers have total control over their projects yet must also manage the operations and demands of their independent ventures.

Main Duties:

Financial Management: Prepare tax filings as a self-employed party and keep tabs on an uncertain income flow.

Maintaining Client Relations: Find clients, secure work, and nourish positive collaboration.

Administrative Tasks: Create invoices, record expenses, and efficiently manage all assignments.

Self-Management: Balance the flexibility with productivity, ensuring deadlines are met.

Tip

Consider using budgeting applications or accounting software to streamline financial oversight and manage irregular incomes.

Are Freelancers Categorised as Self-Employed?

Indubitably, freelancers are categorised as self-employed individuals, contributing uniquely to the broader self-employment narrative.

If you handle taxes as an independent contractor, your status is self-employed. Tax laws across the globe agree that freelancers fall under the self-employed category, distinguishing themselves by relying on their expertise and time as opposed to managing a team or selling goods.

Advantages of Being a Freelance Self-Employed Individual

The appeal of freelance self-employment is growing rapidly across the world. Here are some reasons:

Control Over Work Hours: Establish your schedule to fit other life obligations.

Varied Opportunities: Work with numerous industries, gaining exposure to diverse projects.

Potential for Higher Earnings: Focus on a specific niche for higher rates or broaden services for a larger client base.

Flexibility in Work-Life Balance: Arrange work to meet personal preferences if time is well-managed.

Tip

Setting a regular daily routine can help in maximising productivity while maintaining flexibility.

Conclusion: Exploring Freelancing and Self-Employment

With clear insights into how freelancing intertwines with self-employment, are you prepared to steer the direction of your career?

Freelancing represents a dynamic and flexible way to engage in self-employment, offering the chance to tailor your career around your passions and abilities. To thrive in this arena, one must embrace the duties and hurdles of managing a personal enterprise. Assess your capabilities, ambitions, and readiness to handle this autonomy to ascertain whether freelancing is the correct path for you.