Invoicing and taxes go hand in hand. Learn how accurate invoicing affects your tax returns, why it’s important to keep your records organised, and how modern tools can help you avoid errors and penalties.

The Importance of Correct Invoicing for Taxes

Invoicing and tax obligations are closely related. Every invoice issued represents a record of income or expense that must be included in your tax return.

Errors, late invoices, or missing information can lead to:

Penalties from HMRC (Her Majesty’s Revenue and Customs)

Inaccurate financial records

Issues during a tax audit

The Invoice as a Tax Document

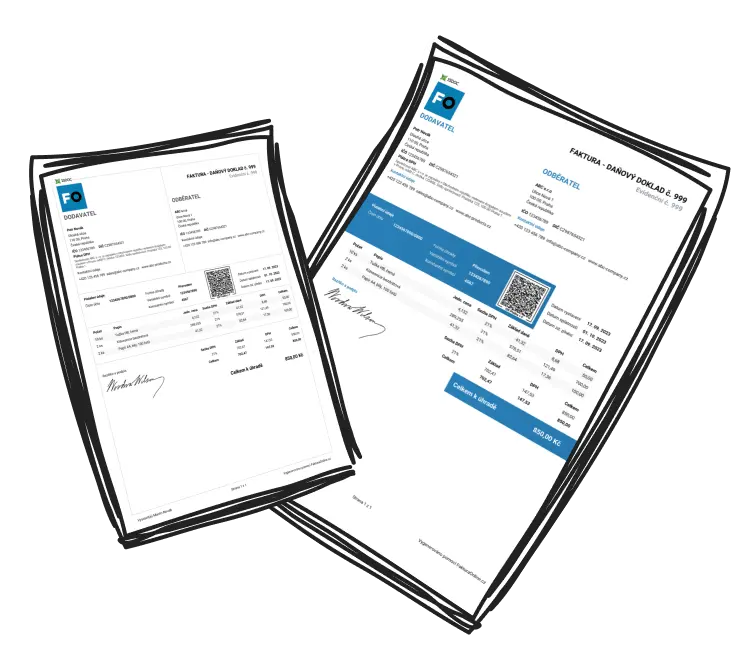

An invoice is not just a request for payment. It’s a legal document that confirms the completion of a taxable transaction.

Invoices must include certain legally required information, such as:

Identification of the supplier and the customer

Issue date and transaction date

Description of the goods or services

Price before VAT, the applicable VAT rate, and the total VAT amount (if you are VAT-registered)

The absence or incorrect details on an invoice can violate tax obligations and lead to penalties.

Types of Invoices and Their Tax Implications

Different types of invoices have varying impacts on your accounting and taxes:

Standard Invoice – Confirms the provided service or delivered goods.

Proforma Invoice – Serves as an estimate and does not affect accounting or taxes.

Advance Invoice – Not subject to tax reporting immediately, but once payment is received, a tax document must be issued for the amount received.

For example, if you issue an advance invoice for £20,000, you will report tax only after receiving the payment and issuing the corresponding tax document for the payment received.

For example, if you issue an advance invoice, you will not report VAT until you receive the payment and issue a tax document confirming the payment.

Invoices and Tax Deductions

Invoices are the foundation for claiming tax-deductible expenses.

To qualify as a deductible expense, the item must:

Be related to business operations

Be supported by a valid invoice

Be recorded in the correct accounting period

HMRC recommends keeping invoices for at least 6 years from the transaction date to provide proof during audits.

Only business-related expenses are tax-deductible. Personal costs cannot be claimed.

During an Audit: The Importance of Order

During a tax audit, invoices represent the most crucial evidence. A well-organised invoicing system allows you to:

Prove the legitimacy of income and expenses

Justify the amount of VAT owed

Avoid penalties for not maintaining proper records

How Online Tools Can Help

An online tool like MyInvoiceOnline.co.uk helps you stay on top of all your documents—automatically tracking deadlines, ensuring the accuracy of your invoices, and giving you an overview of your payments. Save time and avoid unnecessary mistakes.

Summary

Invoicing is not just an administrative necessity—it is a fundamental tool for tax transparency and ensuring the security of your business.

Keep your records organised, stay updated on legal changes, and use automation to ensure timely compliance without stress.

For more details on what a correctly issued invoice must contain, check out our article on What must an invoice include?